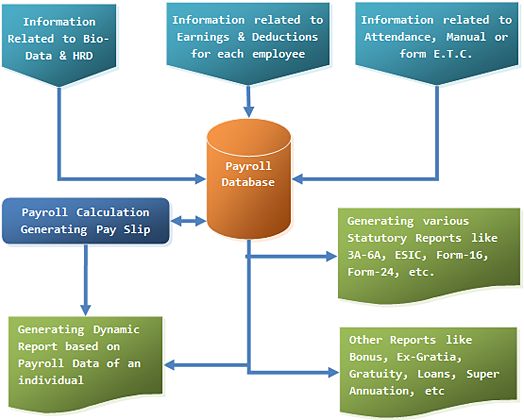

Payroll Module features are as below -

|

|

- Complete parameterised, suitable for any organization. Reduction in data entry.

- Formula based payroll calculation with facility of 999 earning and deduction heads.

Virtually no need to customize.

- All challans and forms required, comply to statutory requirements, including form-16,

24 and 12BA with E-TDS.

- Maintaining record of employee details including job related details, qualification,

work experience etc.

- Formula based grade wise / designation wise location wise / employee wise salary

structure.

- Define statutory parameters for PF, ESI, Superannuating and Gratuity

- Payroll calendar - working days / payment days.

- Professional tax according to locations. (Special Cases like Chennai P- Tax properly

Handled)

- Leave entitlement details for each employee.

- Full attendance transfer to mark 'present' for entire month and update leaves later

to reduce data entry.

- OT tracking and approval and processing.

- Back Period calculation.

- Loan structure update in finance based on installment plan (Reducing Balance / EMI

Method Provided).

- Posting of salary details in financial ledger.

- Employee history - promotions, transfers, salary increments.

- Uploading of attendance from various attendance-recording machines.

- Full and final salary processing in event of employees separation (Under development).

- Salary Slip.

- Salary register.

- Monthly gratuity report.

- PF reports PF challan Form 6A, Form 5 ,Form 3A ,Form 10, Form 12A

- Income tax reports Income tax register Tax computation reports Form 16, Form 24,

Form 12BA.

|

|